I’ve been writing about pending changes to FHA insured mortgage loans regarding the mortgage insurance premiums. Yesterday, HUD issued Mortgagee Letter 2013-04 which makes the proposed changes “official”.

We’ve been anticipating changes to how long mortgage insurance will remain on an FHA insured loan as well as increases to FHA’s mortgage insurance premiums.

It’s no surprise that FHA will increase annual mortgage insurance premiums (paid monthly). The first increase goes into effect with case numbers issued April 1, 2013 and later.

- 30 year fixed with loan to values of 95% or lower will increase to 130 bps (from 120)

- 30 year fixed with loan to values greater than 95% will increase to 135 bps (from 125)

- 30 year fixed FHA Jumbos with loan to values of 95% or lower will increase to 150 bps (from 145)

- 30 year fixed FHA Jumbos with loan to values greater than 95% will increase to 155 bps (from 150)

- 15 year fixed with loan to value of 78.01% – 90% will increase to 45 bps (from 35)

- 15 year fixed with loan to values greater than 90% will increase to 70 bps (from 60)

- 15 year fixed FHA Jumbos with loan to values of 78.01% – 90% will increase to 70 bps (from 60)

- 15 year fixed FHA Jumbos with loan to values greater than 90% will increase to 95 bps (from 85)

NOTE: in the Seattle – King County area, FHA jumbos are loan amounts from $417,001 to $567,500.

But wait… there’s more!!

Effective on case numbers issued June 3, 2013 and later, 15 year fixed FHA mortgages with a loan to value of 78% or lower will have annual mortgage insurance of 45 bps. Currently these loans have zero annual mortgage insurance.

Want to save on your FHA mortgage insurance? Act quickly!! Click here for a mortgage rate quote for homes located anywhere in Washington state.

FHA streamlined refi’s where the current FHA mortgage was endorsed prior to June 1, 2009 are exempt from this adjustment. These loans still qualify for reduced mortgage insurance premiums.

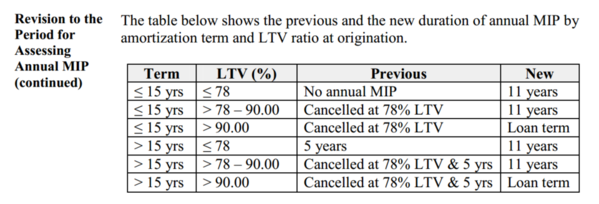

Per the mortgagee letter, this will be effective on case numbers issued June 3, 2013 and later, FHA insured mortgages will change when mortgage insurance can be terminated. Most FHA loans will have mortgage insurance for the term of the mortgage for loans with case numbers issued June 3, 2013 and later.

Here is a chart from HUD comparing “previous” (in effect now until the new regulation) and “new” (in effect with case numbers issued June 3, 2013 and later).

FHA Annual Premium Cancellation

If you are considering an FHA insured mortgage and would like to have mortgage insurance that one day drops from your mortgage payment – you have a couple months left to do so. The FHA Case number is typically (but not always) ordered at application.

I am happy to help you with your FHA purchase or refinance on your home located anywhere in Washington state. I have been originating mortgages at Mortgage Master Service Corporation since April 2000, including FHA loans.

[…] HUD has scheduled another increase to FHA annual mortgage insurance premiums effective with new case numbers obtained April 1, 2013 and later. FHA'a annual mortgage insurance premiums are paid monthly and are set to rise by 10 basis points. […]